Affluent buyers are the white knights who have stepped in to save Miami’s market. They are buying deals at 53% to 50% off the highest price of the property before the housing bubble burst. Miami is America’s real estate default capital. 20% of all homes are in default, or have been foreclosed upon and sit empty. Comparing… Continue reading

Jobs Bill Hijinks

Democrats propose a 5% tax increase on those earning $1 million per year. Media outlets as well as the general public have endorsed this proposal. It is a common refrain to discriminate that they can always afford it. Republicans are being challenged by the Democrats to reject this new provision in the bill. The bill was… Continue reading

Related Real Estate Sites

Many banks are looking to take advantage of the lowest interest rates ever recorded. Today’s 3.94% interest rate drops below 4% in 30 years. Banks also offer incentives to buyers to get them off the fence. These incentives are available in the following categories: Waiving fees – Lowering rates – Waiving certain closing costs Discounting fees… Continue reading

Lowball Appraisals?

Appraisals were largely a matter of course before the 2006 housing crash. The prices rose steadily and any appraiser could just give a number to the buyer to close the deal. It didn’t merit a closer inspection as long as there were comparable numbers in the area. Many complain that appraisers are putting more pressure on… Continue reading

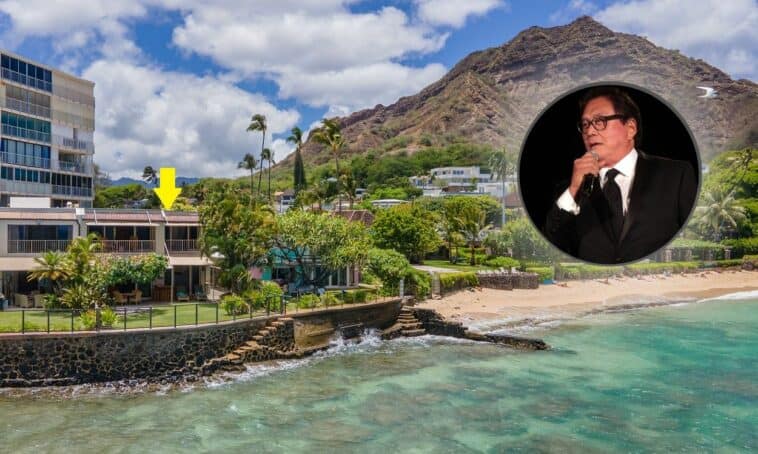

Robert Kyosaki, Author of “Rich Dad and Poor Dad”, Vigorously Buys Apartment Complexes

Robert Kyosaki said that he has made more money in the last three years than any time in his entire life. What’s the most important thing he is buying right now? Apartment complexes ranging from 300 units to 800 units. He says these complexes are the “hottest market in all of Asia right now”. He sees… Continue reading

Tidal Wave Of Foreclosures on the Horizon

Bank of America faces many more problems with its mortgages. These problems stem mainly from the acquisition of Countrywide. Seventeen loans were subject to independent review and seven had “material underwriting defects”. This is a failure by the bankers or underwriters to conduct proper due diligence. Many states have seen foreclosure proceedings halted or slowed down. This… Continue reading

The Economy Created Real Estate Opportunities

People were scared when the economy crashed. The really intelligent people took notes and took deep breaths while they listened. They knew there would be many opportunities. All levels of government are in deep debt. Cities that rely on property taxes are facing huge financial problems. For 2012 and 2013, property taxes are expected to shrink further.… Continue reading

Homeownership Craters

In the United States’ history, homeownership has seen many ups and downs. We have seen dramatic expansions as well as cataclysmic crashes. At the beginning of 2000, home ownership was around 64%. It reached a peak of almost 70% in 2004. In April 2010, it was down to 65.1%. The dramatic plunge of almost 5% in just… Continue reading